Trending

Excise highlights the Excise Department’s vital role in India and to recognise its contribution to government revenue. Tax regulation is critical to sustaining a country’s economic stability. Excise duty, customs duty, and taxes on spirits, tobacco, and other comparable products are used to fund public services, infrastructure development, and social welfare activities.

Because excise and other taxes account for a significant portion of government revenue, effective regulation is critical. The aim of this article is to explain the notion of excise tax regulation, including its importance and total economic impact.

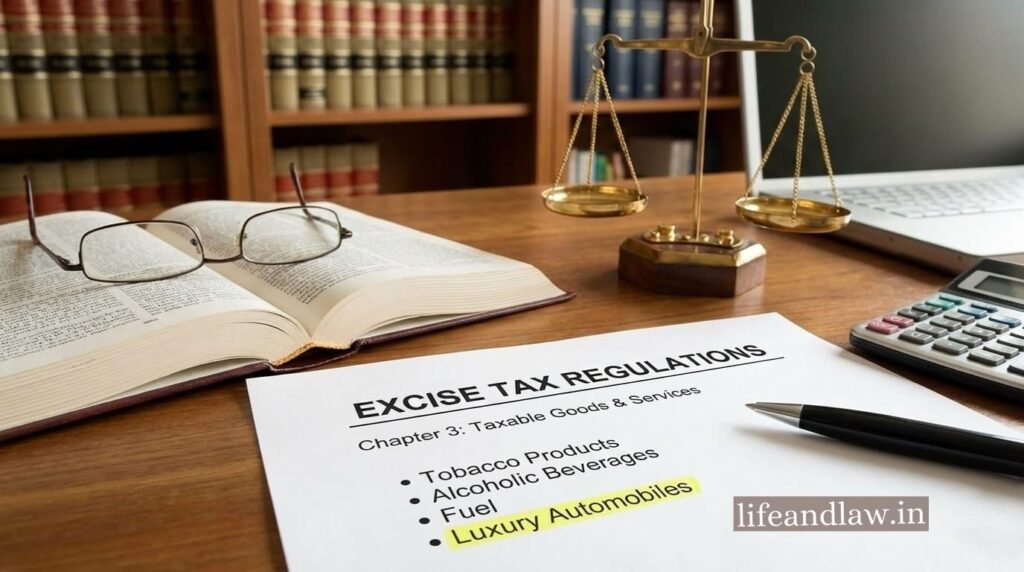

Excise is a tax levied by the government on the manufacture and sale of certain items. This tax mostly applies to spirits, tobacco, petroleum products, industrial goods, and luxury items. It is a vital source of revenue for the government, and excise duty is enforced to ensure the country’s economic stability while also regulating production and commerce.

This tax is not collected directly from customers, but rather from the producer or manufacturing business.

The manufacturer includes this tax in the cost of production and collects it from the end user.

Thus, the consumer bears the actual tax burden, although the manufacturer deposits it with the government.

Excise duty is governed by the Central Board of Indirect Taxes and Customs (CBIC) of the Indian government.

Basic Excise Duty – This is the general excise duty, which applies to most commodities.

Special Excise Duty – Certain products are subject to extra duties.

Additional Excise Duty – Some products are taxed more than others in order for the government to generate more cash.

The British introduced excise tax in India. The Central Excise Duty Act was enacted in 1944, and it formalised the procedure of taxing industrial items in the country.

The advent of the Goods and Services Tax (GST) in 2017 lessened the impact of traditional excise duty, as taxes on numerous products were incorporated in GST. However, excise duty is still charged on certain items, including spirits, petrol, diesel and tobacco.

The excise tax generates significant revenue for the government and is critical to the country’s economic development, public service enhancement, and industrial control.

In 1944, the Indian government established the Central Excise Act, which establishes the authority and methods for levying excise duty on domestically manufactured items.

The government is granted the ability to collect taxes on domestically manufactured items.

It clearly states how excise duty should be levied and who would collect it.

The Act empowers the central government to determine excise duty rates.

To combat tax evasion and malpractice, modifications and monitoring are made on an ongoing basis.

This Act applied excise duty on the following important products –

Medicines and chemical compounds

Metals & Metal Products

Petroleum products

Liquor, tobacco and cigarettes

Automobiles and Electronic Products

On July 1, 2017, the Indian government launched GST (Goods and Services Tax), a major reform that combined the majority of indirect taxes into a unified tax system.

Important changes in excise duty due to GST –

Some excise charges were repealed, and most commodities became subject to GST.

The GST system combines various indirect taxes into a single tax.

This simplified and increased the transparency of the tax system, making it easier for businesses.

Instead of maintaining state and federal taxes distinct, a unified tax system was established.

Even after the implementation of GST, excise duty remains applicable on some specific products, such as –

Alcohol (liquor and its products)

Petrol and Diesel

Natural gas and aviation fuel (ATF, Aviation Turbine Fuel).

Tobacco and related products

Impact on Common Citizens

Taxes increase the cost of some items (petrol, spirits), while decreasing the cost of others.

Tax cuts boost consumer spending.

The consumption of commodities with high levies remains limited.

Taxes on gasoline raise transportation expenses.

Impact on Industries and Businesses

When taxes rise, production costs rise, as do prices.

GST streamlined the tax process, yet some people still face a financial burden.

Impact on Government Revenue

Taxes are used to fund infrastructure projects including roads, energy, and education.

GST has caused changes in the tax collection system.

Higher taxes boost revenue, but they also raise inflation.

Taxation plays an important part in a country’s economy since it generates income for public services. While GST has made tax collection easier, excise duty on individual products continues to affect inflation and consumer expenditure. Balanced tax policies aim to stimulate industrial expansion, reduce evasion,and maintain economic stability.

Adv. Abdul Mulla, who writes about law and policy, agrees with this viewpoint. His insights are published on legal information sites including www.asmlegalservices.in and www.lifeandlaw.in, which focuses on law, governance, and the public interest.

Adv. Abdul Mulla (Mob. No. 937 007 2022) is a seasoned legal professional with over 18 years of experience in advocacy, specializing in diverse areas of law, including Real Estate and Property Law, Matrimonial and Divorce Matters, Litigation and Dispute Resolution, and Will and Succession Planning. read more….

Copyright BlazeThemes. 2025